Lockheed Martin (NYSE:LMT) CEO Jim Taiclet told investors Tuesday during his company’s fourth-quarter earnings call that the Federal Trade Commission (FTC) has filed a lawsuit to block Lockheed’s $4.4 billion acquisition of Aerojet Rocketdyne (NYSE:AJRD), a manufacturer of rocket engines and spacecraft propulsion.

The FTC alleges that if the deal is allowed to proceed, Lockheed will use its control of Aerojet to harm rival defense contractors and further consolidate multiple markets critical to national security and defense.

“As disclosed in our earnings release this morning, we thought it highly likely that the FTC would sue to block the transaction. Since that time, we have received notification from the FTC that they have, in fact, authorized filing a lawsuit,” Taiclet said.

In the meantime, Aerojet also issued a statement to its shareholders and the press announcing the FTC’s decision but held its position that the deal would be a good fit.

“Aerojet Rocketdyne continues to believe in the benefits of the transaction for the United States and its allies, the industry, and all of the company’s stakeholders.”

Unfortunately for Aerojet, the news wiped out as much as 18 percent of its share price, causing it to tumble from $45.07 before the news to $36 at the close.

On Lockheed’s earnings call, analysts sought to uncover the implications if the deal does not go through, especially as it relates to Lockheed Martin’s hypersonic strategy.

Lockheed’s acting CFO, John Mollard, said the merger was in the best interest of Lockheed’s three biggest customers, which happen to be the three largest military services in the U.S.

“One of the benefits of integrating vertically with propulsion and what’s called the glide body, which is the heat-absorbing part of the missile, and then the full air system that supports the missile either out of the tube or off the airplane, the more you can integrate that engineering organization, probably the faster you could go,” Mollard explained.

“We think we could have [obtained] the speed and efficiency increase by partial vertical integration of hypersonic through the [Aerojet] acquisition specifically,” concluded Mollard.

As for how Lockheed will proceed, Taiclet explained that the agreement with Aerojet offers a 30-day window to file a countersuit and that the company’s board would focus on that in the next few weeks.

Solid Financials

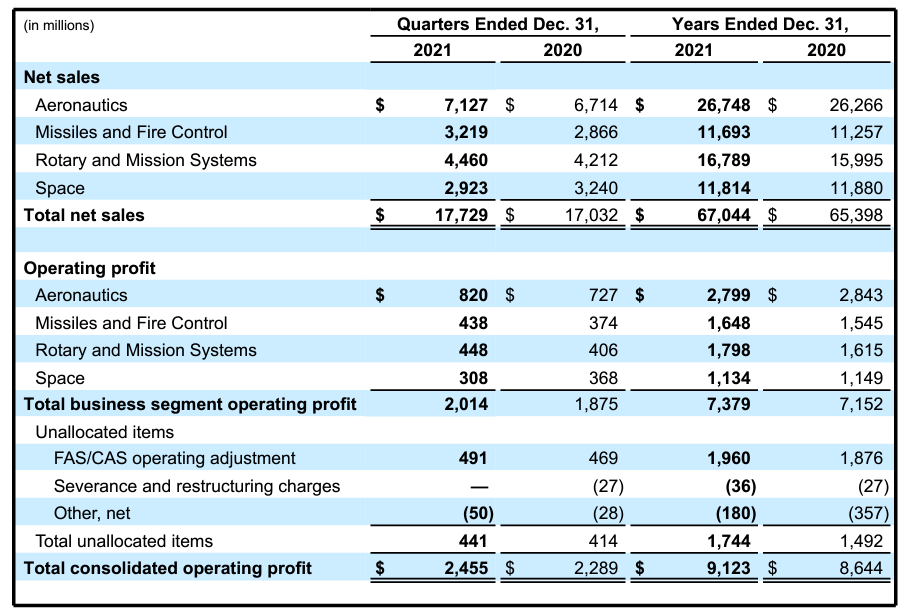

As far as the company’s earnings, Lockheed reported better-than-expected earnings for both the fourth quarter and the full year. Net sales for the quarter totaled $17.7 billion. For the year, the company took in $67 billion.

F-35 Program Sees Strong Demand

Meanwhile, the company broke out the results of its four segments on the call. The aeronautics segment—the largest by revenue—saw sales increase 6 percent year over year to $7.12 billion due to strong demand for the F-35 fighter jet and other classified contracts.

Despite global supply issues, Lockheed delivered 142 F-35s in 2021, three more than its original target, and 22 more than it did in 2020.

Its missiles and fire control program also reported strong revenues, recording a 12 percent increase compared to the same quarter in 2020 to $3.22 billion, and a 4 percent bump to 11.6 billion for the entire year, over the same period in 2020.

Even though the company had installed components on the recently launched James Webb Space Telescope, its space segment recorded the lowest percentage of sales—in fact, losing 10 percent of its business to $2.9 billion. For the full year, it only lost 1 percent, earning $11.81 billion, down from the $11.88 billion it recorded in the previous year.

Company Expects Hypersonics Business to be Big

In the statement, Taiclet shared the company’s focus for the future, which is one investing in emerging technology.

“Through our strong balance sheet, we continue to invest in the many emerging growth opportunities ahead—from new aircraft competitions around the world to our classified portfolio, to solid demand for our signature programs, to emerging technologies like hypersonics.”

On the call, Mollard shared that their long-term sales expectations for the hypersonics business was that it could reach as much as $3 billion by 2026.

“Looking ahead to 2022, we will remain fully dedicated to service to our customers and dynamic and disciplined capital allocation for the benefit of our shareholders,” Taiclet said in the release.

Taiclet even offered that Lockheed was in a good position to outlast any supply-chain disruption.

“We think the bow wave has passed in supply-chain disruption for Lockheed Martin, but we’re still watching it closely,” he said.

As for guidance, Lockheed predicts that for the full-year 2022, earnings per share will be $26.70 on $66 billion in revenue.

At the close of business Tuesday, its share price was up 3.5 percent to $387.