Shutterstock

The embossed certificate I received as a 6-year-old boy after climbing aboard a Lockheed Electra for my first airline flight is a cherished possession. Not only did the certificate record that memorable moment, but it also promised a pilot interview 20 years later. Although I hedged my bets by interviewing with other companies, no other airline really existed for me. After 29 years of employment with my dream airline, the thought of merging with another carrier is foreign to my psyche.

But it appears that I will soon face a new reality. A merger with my airline may have already occurred by the time you read this column.

In 1978, President Jimmy Carter signed the Airline Deregulation Act into law. The primary intention of deregulation was to give consumers the benefit of competition. The authority to regulate fares and route structures was taken away from the government. Overnight, air travel became affordable to almost everyone. Even today, inflation-adjusted fares indicate that the average ticket in competitive markets has actually decreased far below pre-deregulation prices.

With any industry, competition has its casualties. Names like Braniff, Eastern, Pan Am, TWA and many more disappeared. Astute analysts predicted not only the demise of some airlines but also the fact that the industry would run full circle toward its own regulated environment.

A declining economy, overcapacity and a major terrorist event forced the government to accept consolidation as a solution to preserving the country’s air-transportation infrastructure. Mergers that would never have been considered in the past were approved by the Department of Justice. Today, only a handful of major airlines remain standing. In the short term, it appears that consumers still benefit from lower fares on competitive markets, but the long-term effects remain to be seen.

When an airline merger proposal is announced, most of the traveling public reacts with a yawn. After all, it’s only the paint on the side of the fuselage that will change. Joe Traveler might have to suffer a small percentage increase on the price of a ticket, but for the most part, everything remains the same. The integration of two companies occurs almost overnight. Right?

Of course the story is a lot more complicated. But rather than discuss all the aspects of a merger, allow me to give you the airline pilot’s perspective.

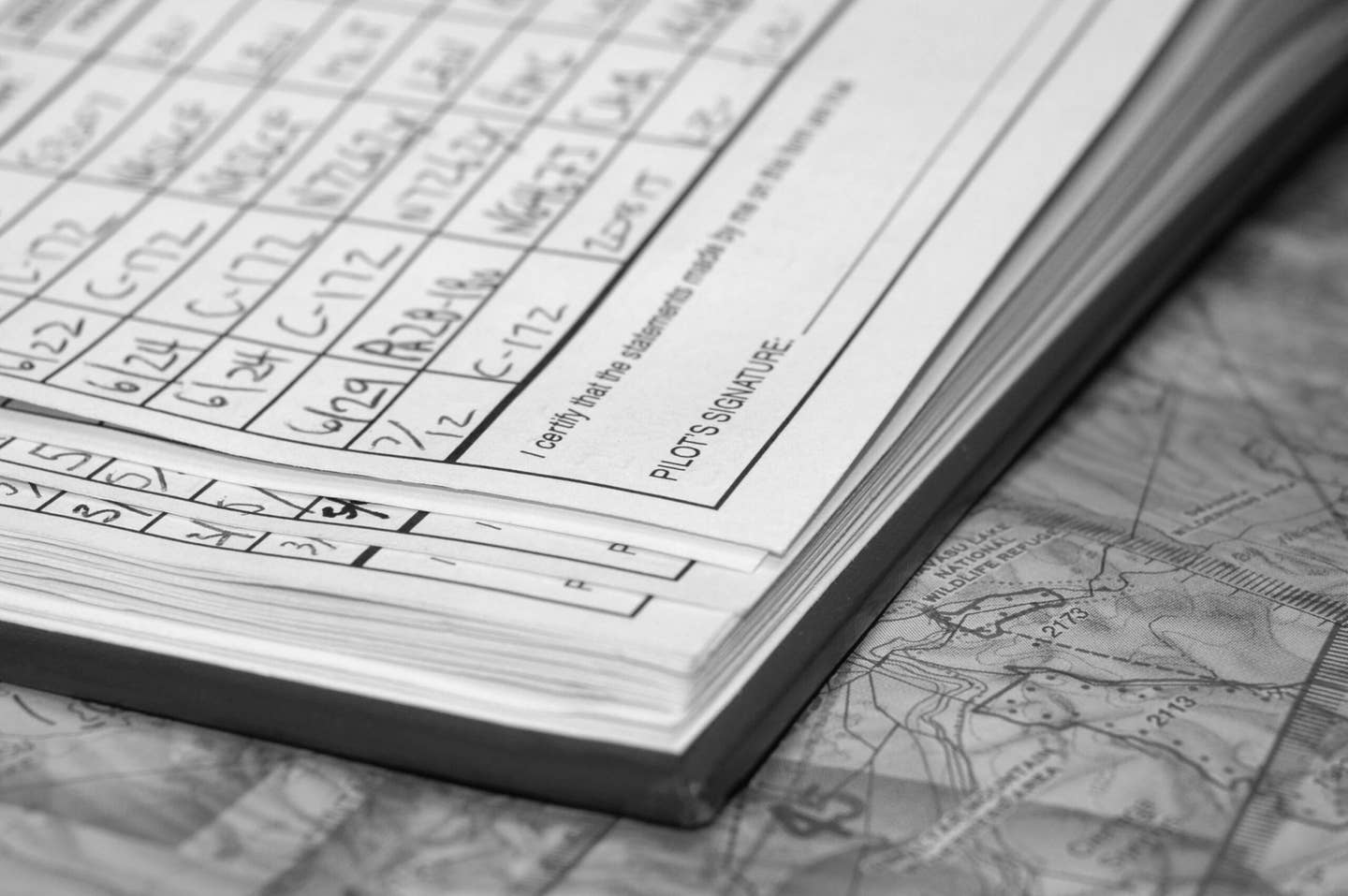

If an airline pilot were to participate in a word association game, I am almost certain “merger” would prompt a response of “seniority.” Seniority — determined by one’s date of hire — is our world. Seniority defines our schedules, our opportunity for advancement, our vacations, our pay rate and our likelihood of furlough or recall. Because seniority is non-transferrable to other carriers, we are married to our company. Employment with another airline means starting at the bottom of the seniority list.

So how does one pilot group merge with another without creating seniority havoc? It is often said within my profession that a good labor contract creates unhappiness for everyone. The same can be said for seniority integration. Although discussed tongue-in-cheek, the “staple method” is sometimes suggested. In this method, one pilot group’s list gets stapled en masse to the bottom of the other’s. This method doesn’t quite achieve labor harmony.

In general terms, the protocol for seniority integration involves reasonable expectations. What do I mean exactly? The negotiation process that takes place between two pilot groups considers the career-advancement expectations of its members had the merger not taken place. As an example, under nonmerger circumstances, assume that the copilot on a Super 80 expected an opportunity to transition to the same position on a 767. If a particular seniority integration scenario changes that opportunity, how can that expectation be mitigated?

The answer is complicated. Oftentimes with pilot groups of disproportionate sizes, a ratio is utilized. And because it is common for past hiring to have occurred within a specific window of years, ratios are applied differently.

The main source of reducing damage to advancement expectations is most likely the application of a fence. A fence prevents pilots of one airline from jumping to the equipment of the other airline until a specific period of time has passed, typically five years. The fence also mitigates training costs.

Speaking of training, a merger poses new challenges. Each airline has its own pilot-training facilities. Should they be consolidated? What if the two carriers have different airplane types? Logistics notwithstanding, does the combined airline change its training syllabus and methodology? Part 121 carriers have an FAA-required and -approved training structure with regard to management. How is the responsibility re-delegated? Who stays, and who goes?

From an operational standpoint, philosophies differ among airlines. Checklists are different. Procedures are different. Performance and flight plan data is obtained and presented differently depending upon the IT infrastructure.

Standard operating procedures are important components of safety. How do you design those procedures to maintain simplicity over a bigger fleet and a bigger pilot group? When the right engine of a 737 throws a fan blade and causes a catastrophic failure, you don’t want the crew asking, “We secured the engine this way at Airline A, but with Airline A+B, how do we do it now?”

Most public discussion centers on the route structure of the new airline. How does the route structure overlap? How does it strengthen? For pilots, a new route structure defines new destinations. New destinations can be both exciting and challenging. Each pilot’s airport experience is an important aspect of safety.

From a labor viewpoint, contracts among pilot groups can have major differences. Consolidating contracts is a tedious process. As an added stress, some airlines have the baggage of contracts from previous mergers. It makes the goal of uniformity difficult to achieve.

For those of us that have experienced the pleasures of bankruptcy and had our pensions genetically altered, another challenge is presented. The new combined airline has to take on the responsibility of those pensions. If it fails to remain solvent, future retirees will suffer the consequences — again.

Employee benefits between the two companies are most likely dissimilar. As an example, pass privileges for travel, a valued and accepted part of our business, may have different protocols. One airline could use seniority for the employee and his or her qualified family members while the other airline utilizes a first-come-first-served system.

On a broader scale, every airline has its own personality. As pilots, we treat each other with dignity and respect no matter the uniform, but distinct cultures within companies often prevail. That culture is hard to completely eliminate, even when two airlines combine. Certainly, a friendly rivalry is preferable to an adversarial atmosphere. Regardless, as younger pilots who have not been exposed to the wounds of a merger replace older pilots, a new atmosphere will be created.

Assimilating into a new environment may be awkward for all of us. For the moment, the olive branch seems to have been well received by both pilot groups. I will have no difficulties extending a hand to my new colleagues. We have both experienced similar challenges over the course of our careers.

The difficulty for me will be sentimental. That certificate I received as a wide-eyed 6-year-old will always represent the airline I admired. I hope the airline it transforms itself into becomes the same source of admiration for another 6-year-old child. Time will tell. I only wish that I could be around to greet that kid when he slides into the right seat of my airline’s cockpit with his shiny new wings for the very first time.

We welcome your comments on flyingmag.com. In order to maintain a respectful environment, we ask that all comments be on-topic, respectful and spam-free. All comments made here are public and may be republished by Flying.

Subscribe to Our Newsletter

Get the latest FLYING stories delivered directly to your inbox