Airline Flying in the Post-Pandemic Era

The furloughs and early retirements COVID-19 caused have exacerbated the pilot shortage.

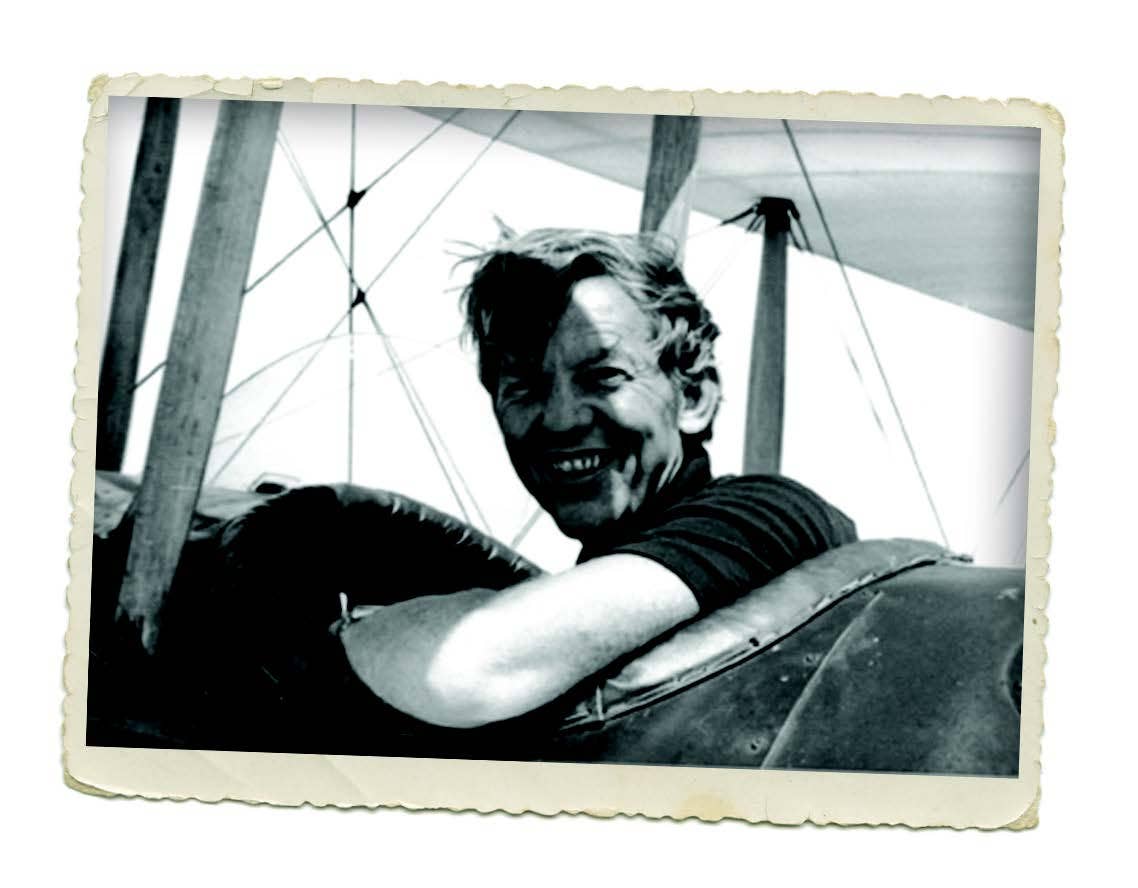

[Photo: Sam Weigel]

On the bright blue morning of March 12, 2020, my wife Dawn dropped me off at an eerily quiet Orlando airport, where I commuted north on a strangely empty airplane to a bewilderingly uncrowded Atlanta airport to begin my first day of line flying as a newly-minted Boeing 737 captain. I checked in at the main crewroom, which normally thrums with activity—it was dead silent. There were plenty of pilots there, but they mostly wandered alone, gray and ghostlike, eyes studiously averted.

A few gathered around the north wall where three TVs were silently replaying the unthinkable announcement: The U.S. borders were closed, indefinitely, to most citizens of the European Union. The modern world’s busiest commercial air routes were severed, my airline’s bread and butter swept clear from the table with small domestic scraps offering little hope of sustenance. I closed my eyes and repeated the mantra that has sustained me through my career: “This too shall pass.” I set off to find my assigned check airman and master the intricacies of the 737.

“I closed my eyes and repeated the mantra that has sustained me through my career: “This too shall pass.””

On October 1, 2021, I checked in for a three-day trip at Seattle-Tacoma International Airport, my first trip as a Seattle-based pilot. Against all odds, I was still a 737 captain. My airline was smaller—thanks to two retired fleets and 1,800 pilots who had taken an early-out package—yet management was now scrambling to add airplanes and pilots to meet the surging demand for air travel.

Every flight on my trip was booked full, as most of my flights throughout the summer had been. My first officer, Dan, was brand new to the fleet, having just returned from more than a year on UNA or “Unassigned” status, the limbo-land that he and 1,700 of his fellow junior pilots inhabited throughout the pandemic—at one point, within 24 hours of being furloughed. The second CARES Act and a long-overdue agreement between the company and pilot union saved the day. Now, I welcomed Dan back to the airline and told him to expect me and every other captain to buy his layover beers for the next year.

We’ve all made our peace, one way or another, with the new normal, and the world moves on. In our little airline-centric world, that movement has manifested itself in an explosion of demand for domestic and near international leisure travel, a less-enthusiastic rebound of business traffic, and a distinct lag in the return of transoceanic flying.

Aviation has always been a cyclical beast, with fairly regular storms threatening the livelihoods of pilots, who have little choice but to ride the industry’s booms and busts to their ultimate conclusion. I was very much on the periphery at the start of the last major cataclysm—9/11—completing my senior year at the University of North Dakota. And yet, 9/11 reverberated throughout the airline industry for well over a decade.

This storm was different. Initially, COVID-19 looked catastrophic to the airlines, with a precipitous decrease in domestic traffic and near-cessation of international flying that dwarfed the immediate fallout of 9/11. Every junior pilot in the industry went into immediate survival mode, cutting all unnecessary expenditures and preparing for the inevitable furlough.

And yet, there were some key differences between COVID and the 9/11 era. Consolidation had reduced seven legacy major airlines to three, and they were all in a much stronger financial position in 2020 than they had been in 2001. The consolidated airlines had also become much more powerful politically, and had effectively become “too big to fail.” And lastly, there was no well-funded, hungry low-cost carrier ready to fill the major airlines’ shoes, as Southwest and JetBlue were after 9/11—Spirit was just as starved of passengers as United.

Still, faced with the specter of empty airplanes, silent airports, and voracious cash burn, one can forgive airline management for overreacting, cutting everything to the bone. They assumed this storm would be like the last one, with a half-decade or more before recovery. At least in the regional airline sector, panic was well-justified: five years of turmoil had left them much weaker than the majors, and the pandemic quickly claimed three victims (Trans States, Compass, and ExpressJet).

My employer came extremely close to giving those 1,700 junior pilots the axe, even after all the early retirements. Our management did a good job of handling the financial, network, and public relations challenges of the pandemic, but they were stubborn and callous in their dealings with the pilots. At least they came to their senses at the last minute—one of our competitors furloughed 1,600 pilots. Other carriers were smarter, paying their pilots a partial salary to stay at home during the darkest days of the pandemic, thus keeping the majority ready to return to full-time flying with minimal retraining.

Besides recalling furloughed, unassigned, and voluntary-leave pilots when demand returned, all three legacy major airlines have started hiring new pilots as fast as training capacity allows. This means that the regional airlines are right back where they were two years ago, in the middle of a pilot shortage threatening their existence.

On August 30, 2021, American Airlines’ three wholly owned regional airlines (Envoy, PSA, and Piedmont) unveiled a Pilot Retention and Bonus Program, which offered hiring bonuses ranging from $15,000 to $40,500, a $30,000 captain upgrade bonus, and payments of $70,000 to $120,000 upon acceptance of a guaranteed flow slot to American Airlines. At the same time, new hire pay was increased to $51 an hour. Still unable to attract enough qualified applicants, PSA started sponsoring Australian pilots for E-3 visas.

Every regional is in the same spot, and it’s rather comical seeing them falling all over themselves to attract pilots they so recently found worthless. Republic Airways recently paid up to $17,500 in hiring bonuses over the course of 36 months; at Air Wisconsin, it’s $45,000; and Horizon Air upped its bonus to as high as $50,000. Where cold hard cash fails to produce applicants, the regionals tout career progression: most now have some sort of flowthrough or guaranteed interview with their major airline partner. There’s still no sign of a true sponsored ab-initio program, though; really, only the major airlines have the resources for that, with increasing rumblings in that vein.

Intriguingly, SkyWest has mostly stayed aloof on bonuses, yet seems to be filling their classes. They’ve always been one of the best-managed regionals, which isn’t saying much in a sector that’s basically a clown car of major-airline-management rejects. One of SkyWest’s surprisingly radical ideas is a year-for- year compensation match for those who defect from other airlines; you don’t have to start over at year-one pay. If I were an itinerant young pilot, I would spend the next decade rolling around the regional airline industry sucking up hiring bonuses, and then slide into SkyWest at year-10 pay.

The shortage will affect even recreational pilots, though, every time you add a new rating or get a flight review. For instructors and other professionals, it will greatly increase your options going forward and reduce the time required to recoup your investment in training. Those already at the regional airlines won’t have the “golden handcuffs” binding them to their current employer. Professional pilots without the least interest in airline flying will benefit as well.

If you still choose to make a career of flying, you need to accept the instability, and be ready to ride the tides. But as I’ve often said, a rising tide lifts all boats.

This article originally appeared in the Q1 2022 issue of FLYING Magazine.

Subscribe to Our Newsletter

Get the latest FLYING stories delivered directly to your inbox