What Are Your Options When Financing an Airplane?

The FLYING staff delves into the myths associated with financing an aircraft.

Having an adviser specializing in aircraft financing can help you to navigate the most likely path to securing the funds for the transaction. [iStock]

While an approach to minimums in a light twin may leave you with your hands full, most pilots recognize the path to proficiency and success in this scenario. What may not be as clear—if you don’t come from a finance background—is how to turn the dream of owning an airplane into reality.

As FLYING Media Group expands its portfolio of services to pilots, it recently acquired Sky Allies Capital, a nimble player in the aviation finance market, to help our readers find the path to aircraft ownership. Now, as FLYING Finance, the team we’re bringing on board will assist pilots in transitioning to owners, whether the deal is for a light sport airplane or a super-midsize jet.

If you're not already a subscriber, what are you waiting for? Subscribe today to get the issue as soon as it is released in either Print or Digital formats.

Subscribe NowWe sat down with Josh Colton, founder of Sky Allies, to break through a few barriers pilots may perceive in getting started. Colton comes from a background in marketing and finance, including time at Cessna Aircraft Co.—now Textron Aviation—in a variety of roles in marketing strategy and channel development. Colton holds a Master of Business Administration degree and an airline transport pilot certificate with type ratings in the HondaJet and Citation 525 series.

“First, it’s important to understand that the aircraft you pursue drives to a large extent the kind of financing that will be available,” says Colton. “Whether it’s a light piston single or a warbird or a jet, they all involve different types of financing. For experimental aircraft, you are typically looking at a home equity loan or line of credit, or cash, whereas with a jet, a bank loan is most often the vehicle.”

That’s why having an adviser specializing in aircraft financing can help you to navigate the most likely path to securing the funds for the transaction.

“If you go to your own credit union or bank, most banks don’t understand aviation,” says Colton. “Plus, you may need to hire an attorney to do documentation on the deal and/or ownership structure, hire an appraiser, and help with insurance and closing. If you’re working with a finance broker, they’re going to do a soft pull of your credit, tax returns, etc., and provide you with a path. It’s easier than going it alone, as they can advise the best match.”

And what’s the cost of going through a financial broker? “If we do our job right, it won’t cost any more than going direct to a bank—sometimes it does. Sometimes it costs less,” says Colton.

Financing Options

Aside from cash buyers, there are typically two paths that private owners take and another option for those pursuing assets for commercial operations. Bank loan terms are generally 10 to 20 years, depending on the age of the aircraft and total time on the engine and airframe. Or a buyer could draw cash from a home equity loan. For these loans, Colton says, you’ll need to put 15 to 20 percent down on the personal loan—usually 20 percent—with interest rates floating around 7 to 8 percent at press time.

Another path would be aircraft leasing—and it’s not for private operators, normally, according to Colton—but if you’re looking at conducting Part 135 operations or running a flight school under Part 141, you might pursue this direction. For example, Colton has had another business that leases a Cessna 172 to a school.

“It has to be for a business’ essential purpose,” he says, “so if you’re flying Cessna Caravan for cargo ops, that makes sense, but if you buy one to get to your lake house and you want to lease it, that probably won’t work.”

The advantage to a leasing arrangement is that you may be able to get 100 percent financing for the deal, putting no money down as part of the transaction. The downside? There’s often a 10, 12, or 14 percent rate on that, according to Colton.

Taking Care of the Customer

Colton credits one of his mentors at Cessna, retired senior vice president of sales and marketing Roger Whyte, as inspiration for how he approaches financial brokerage.

“Whyte’s credo was always to treat your customers well, so they would come back,” he says.

In order to ensure that, the idea is to keep the timeframe no longer through a broker than the process would be through a bank.

“It’s like hiring a real estate agent—if they are a pro, they save you time and money,” Colton says.

Brokers can also offer creative ways to access capital, including using cars, rental homes, or other assets to get to the desired line of credit. If someone has been declined by their bank, “we can go do creative deals as well,” mitigating the effects of having a B- or C-grade credit—as opposed to the A or A-1 credit most financial institutions look for in conventional loans. Pilots are typically a good risk.

“There are very few losses in aircraft finance, if the banks do their market research,” says Colton.

Finally, just like on the flight deck, having a procedure mapped out ensures preparation and that no steps are missed.

“We have a checklist to follow with those seeking financing for an aircraft,” he says. “We consider the prebuy [inspection], damage history, getting an airplane with a mid-time or less engine if it’s going to be financed, or structure the loan that way. If it’s a jet, finding an airplane that’s on an engine program of some kind…it dramatically cuts into the universe of lenders available if the jet is not on a program, so be prepared for the process to take longer and cost more.”

All of the information Sky Allies has collected over the years “flows back into the type of loans that we do,” says Colton. “An asset—the airplane—on the other side could be 60 years old or brand new, an SR22, or a warbird. We have that all in our database to match people with the right lender and loan structure. As a result, we usually work with our top 10 lenders out of a large pool, and that’s what we bring to the table along with industry specialization.”

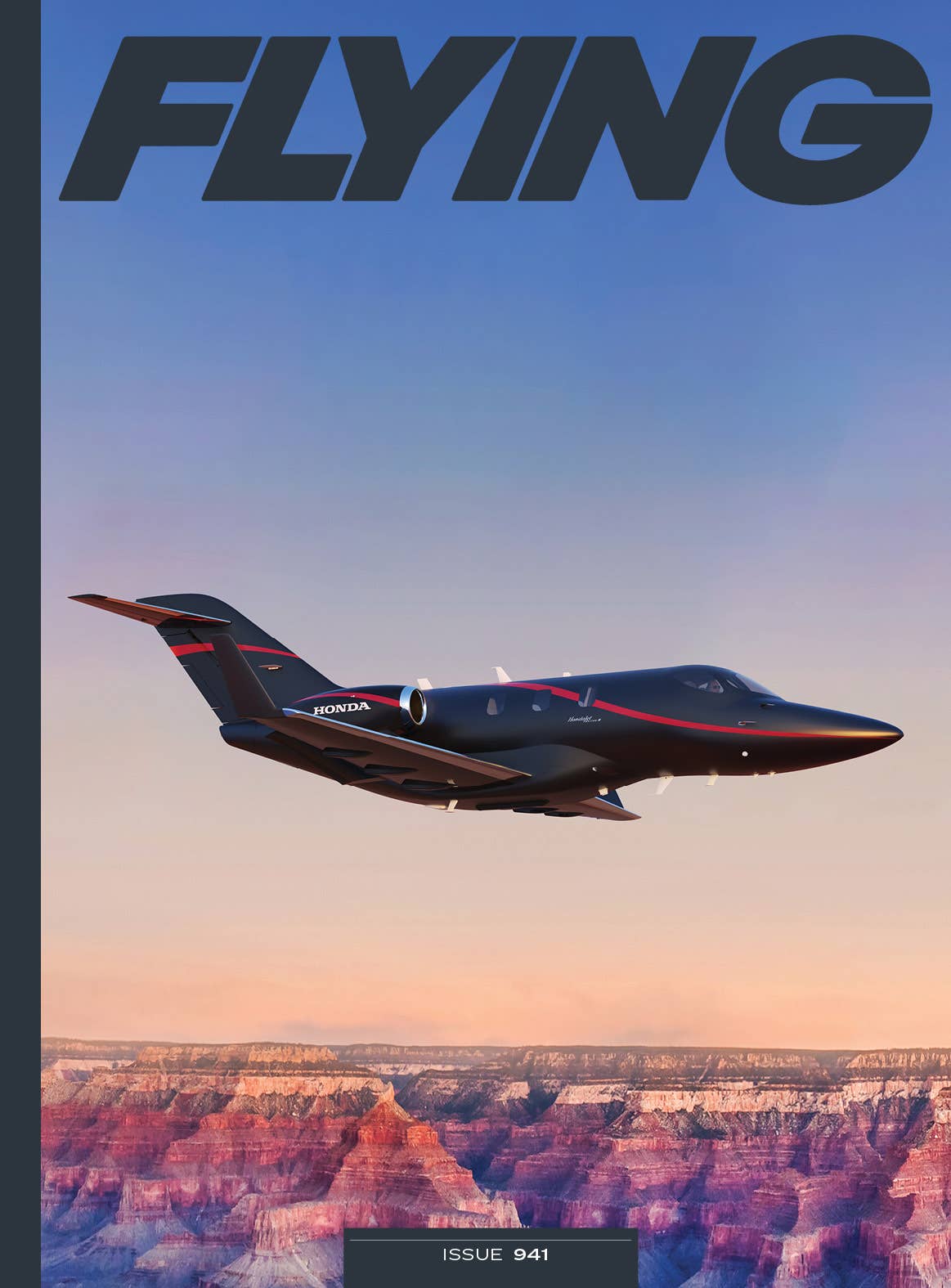

This story first appeared in the September 2023/Issue 941 of FLYING’s print edition.

Subscribe to Our Newsletter

Get the latest FLYING stories delivered directly to your inbox