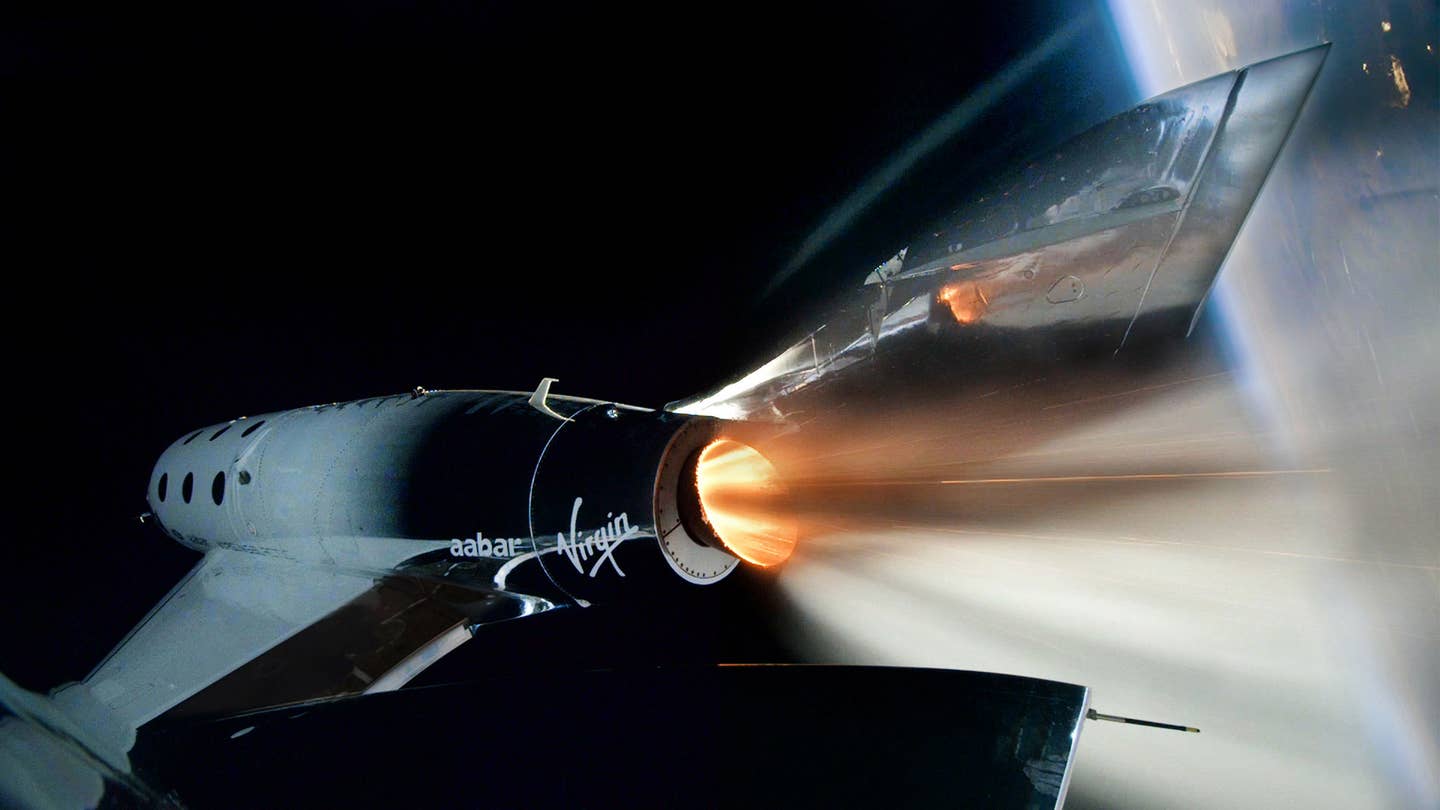

Virgin Galactic’s VSS Unity rockets to space on historic first spaceflight. Virgin Galactic

Virgin Galactic (NYSE:SPCE) became the first space tourism company to be publicly traded on the New York Stock Exchange Monday, October 28, following the completion of a merger with holding company Social Capital Hedosophia (SCH). The total SCH investment of $800 million adds to the $1 billion already invested in Virgin Galactic since it was founded in 2004 by Sir Richard Branson.

The merger with SCH was announced in July 2019 and approved by shareholders last week, which allowed the launch of the public NYSE sales to proceed. SCH is expected to own up to approximately 49 percent of the combined company, with Branson and Virgin Galactic retaining a 51% controlling ownership stake.

Public stock of Virgin Galactic began trading with a per-share price of $11.49 at the opening bell of the NYSE on Monday, with 7.9 million shares traded under the symbol SPCE in the first two hours, an indication of early interest by investors. Over the weekend, online rumors circulated indicating the stock might see a “moon shot” in price increase on its first day of trading, but that never materialized as the stock rose to a day high of $12.93 before closing flat at $11.75 despite heavy volume of 12.8 million shares traded.

“Great progress in our test flight program means that we are on track for our beautiful spaceship to begin commercial service,” said Sir Richard Branson, founder of Virgin Galactic. “By embarking on this new chapter, at this advanced point in Virgin Galactic’s development, we can open space to more investors and in doing so, open space to thousands of new astronauts. We are at the dawn of a new space age, with huge potential to improve and sustain life on Earth. I am delighted that SCH has decided to become such an important part of our amazing journey. They share our dreams and together we will make them reality.”

Even while the company has only made two crewed spaceflights, with one resulting in a fatal accident, Virgin Galactic said the company has built a pre-commercial service order book of more than 600 space tourism customers backed by over $80 million in deposits. A BBC report stated that Virgin Galactic has a goal to make 16 trips to space with customers as soon as next year, and by 2023, the company expects to make 270 trips to space from Spaceport America, its dedicated launch facility in New Mexico.

Other companies racing to become the first to launch regular commercial space tourism service are Tesla founder Elon Musk’s Space Exploration Technologies Corp., better known as SpaceX, and Amazon CEO Jeff Bezos’ Blue Origin.

Subscribe to Our Newsletter

Get the latest FLYING stories delivered directly to your inbox