Why is the Auto Industry So Interested in eVTOLs?

A new partnership between Eve Air Mobility and Porsche is just the latest example of the strengthening alliance between eVTOL and the auto industry.

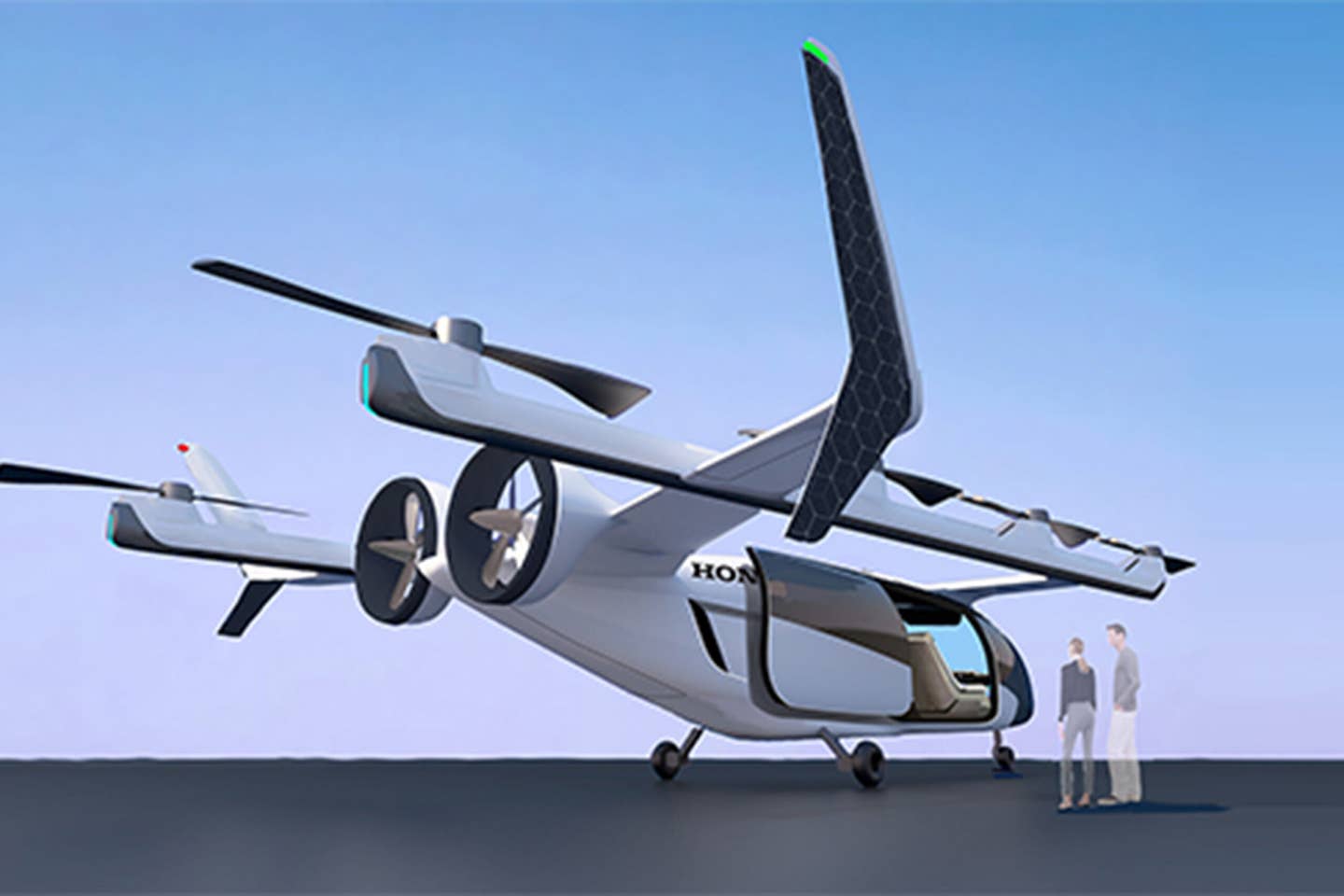

Honda unveiled its eVTOL and electric transportation ecosystem concept last year. [Courtesy: Honda]

Embraer’s Eve Air Mobility (NYSE: EVE) and Porsche (OTC US: POAHY) announced this week they’re collaborating on global manufacturing and other macro strategies for Eve’s electric vertical takeoff and landing (eVTOL) aircraft. The partnership is just the latest example of the strengthening alliance between eVTOL and the auto industry.

It’s a critical time in this emerging sector, when capital funding and expertise can make the difference between success or failure. Several leading air taxi developers aim to achieve certification for their new aircraft within the next few years, and they’re now looking to strengthen their plans for eventual manufacturing programs. Air taxi developers are partnering with automotive companies across multiple roles, including suppliers, investors, and consultants.

The list of collaborations is long, but here are some examples:

- California’s Archer Aviation (NYSE: ACHR) is working with Stellantis (formerly known as Fiat Chrysler) (NYSE: STLA)

- Hyundai has created its own eVTOL spinoff: Supernal.

- Honda is also planning to produce its own air taxi.

- Germany-based Lilium (NASDAQ: LILM) recently announced a deal with Japan-based Denso.

- Volocopter, also based in Germany, has partnered with Mercedes -Benz parent company Daimler (OTC US: DDAIF).

- California-based Joby Aviation (NYSE: JOBY) has Toyota (NYSE: TM) as a major investor.

- In Japan, Suzuki is backing an eVTOL startup called SkyDrive.

Although Henry Ford was once a major player in both sectors, partnerships between traditional aviation OEMs and automotive manufacturers have been more sporadic—though Porsche itself has a track record here, having partnered with Mooney Aircraft Company in the late 1980s to create a Porsche-engined Mooney M20L or Mooney PFM, from 1988 to 1990.

Now that investors are pouring hundreds of millions into eVTOL development, it's worth asking: Why is the automotive industry so interested?

Electrification

One reason: Electrification. With the advent of electric cars and trucks, some automakers are drawn to the potential of electrifying all forms of transportation—including aviation.

“Air transportation has been a long-term goal for Toyota, and while we continue our work in the automobile business, this agreement sets our sights to the sky," said Toyota Motor Corporation president and CEO Akio Toyoda in 2020, after announcing its collaboration with Joby.

Electrification is driven largely by the push to reduce transportation’s carbon footprint by creating zero-emission vehicles and aircraft.

Manufacturing at Scale

Another big reason for increasing auto industry partnerships with eVTOL: Manufacturing expertise.

Major eVTOL developers are planning to scale up manufacturing and flight operations enough to pay for the high cost of developing and building aircraft. Eventually some companies hope to produce tens of thousands of air taxis—many more aircraft than traditional airplane manufacturers. This will require optimization across manufacturing and supply chain.

“That’s much more akin to what the auto industry does in terms of scale, production, and cadence,” says Edison Yu, a Deutsche Bank analyst for the air taxi industry who has also spent years analyzing the auto industry. “Automakers realize their expertise is at producing very complicated vehicles at scale. They can offer manufacturing prowess to these companies as a way to tap into a potentially lucrative opportunity.”

In fact, experts say the market is there. Last year Morgan Stanley projected the total addressable market (TAM) of Urban Air Mobility (UAM) at more than a trillion dollars by 2040. “Honestly no one has any idea, I think, how much it truly could be,” Yu says. “I don’t think the UAM piece alone could be a trillion.”

EV Overlap

Air taxi development also overlaps in multiple ways with the emerging electric vehicle (EV) space. Although high-performance battery systems required for eVTOLs will be much more robust than EVs, there could be valuable synergy across battery-cell development and expenses. Auto companies are going to be more adept at scaling production of eVTOL batteries and lowering their cost.

Let’s not forget about the available labor force and potential employee overlap. Leading eVTOL developers have recently been luring engineers specializing in powertrains and battery systems from places like Tesla and Apple —which is working on a self-driving car, Project Titan.

Branding and Passenger Acceptance

Passenger acceptance is an issue often discussed by leaders in the eVTOL space. There are many questions about how long it would take passengers to feel comfortable about flying on a new form of air transportation.

An air taxi operator flying an aircraft with a well-known automotive brand with a reliable reputation may be at an advantage. Would passengers be “more willing to fly on something with a brand that they’ve heard of before, which they perceive as safe?” asks Yu. It’s a great market research question that could yield fascinating results.

Transportation Ecosystem

Some industry leaders envision the two sectors eventually could be part of a unified transportation ecosystem.

Last year Honda unveiled a concept for an entire electric transportation ecosystem that would be coordinated by a ride sharing app. The idea offers an example of what could come from both the eVTOL and automobile industries working together: providing environmentally friendly mobility with seamlessly connected transportation service across ground and air.

With its HondaJet, Honda has already made its mark in aviation. Mitsubishi also has aircraft manufacturing expertise and experience. Does that heritage make them a more valuable partner in an eVTOL partnership?

“Heritage, while important, may be a little bit overrated,” Yu says. “It’s almost more about moving fast and having the right team of people. On the certification side, heritage could help. But it’s not as big of an advantage as it may appear.”

Analysts agree that Toyota and Joby Aviation make for a powerful combination, largely because of the length of their partnership and Toyota’s legendary manufacturing and production processes. Archer Aviation’s partnership with Stellantis is also a significantly valuable collaboration, experts say, citing Stellantis’s Detroit legacy that includes legendary brands like Chrysler, Jeep, and Dodge.

When Ford Built Airplanes

As we mentioned earlier, Ford took an early interest in airplanes—eventually manufacturing the Ford Tri-Motor airliner.

The all-metal “tin goose” helped prove commercial air travel could be reliable and safe. Sadly, the Great Depression forced Ford to end production of commercial aircraft.

Given the historic precedent and the apparent synergies, it stands to reason that air taxi developers and automotive manufacturers could prove to be a powerful combination as the emerging eVTOL industry comes to fruition in the next few decades.

Subscribe to Our Newsletter

Get the latest FLYING stories delivered directly to your inbox